Talk to a Mortgage Broker Who Knows

How Lenders Actually Make Lending Decisions

Home buyers, investors and self-employed borrowers across Australia.

Get started online or book a call with one of our brokers — whichever suits you.

No obligation · No credit checks · Experienced brokers

Referred to us directly? You’re welcome to contact your broker on their direct number below.

Real clients. Real outcomes.

When lending is complex, outcomes depend on how deals are prepared, structured, and managed through assessment.

Client story: Structured lending for complex circumstances

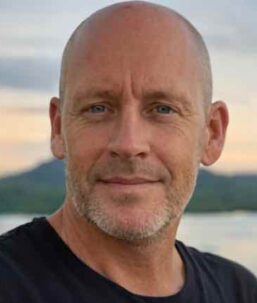

“I thought I could do it myself. I quickly realised I couldn’t — and working with experienced brokers changed everything.”

- Steve Hare, Global Finance Professional & long-term client

How We Work

Lending outcomes can vary significantly depending on how income, expenses, and structure are assessed — and how that information is presented.

Our brokers bring deep experience in how lending policy is applied in practice across a wide range of borrower scenarios, including experience within bank head office and credit environments.

Applications are prepared and reviewed within a team structure, not carried by a single individual.

Working with our team means:

- Access to panel and non‑panel lenders

- Understanding how different lenders assess the same information

- Structuring applications to suit your circumstances

- Managing changing conditions and lender requirements

Experienced brokers supporting home buyers, investors and complex lending scenarios across Australia.

Why Structure Matters

Lenders make decisions based on how information is presented — not just what it contains.

We use a single, structured intake to gather information once.

Required authorities and permissions are completed separately, in line with compliance requirements.

Before anything is submitted, we review, prepare, and structure the application so it is presented clearly and consistently for lender assessment.

This avoids duplicated forms, fragmented paperwork, and repeated explanations — helping applications progress more smoothly while protecting lender relationships.

The result: clearer decisions and more reliable outcomes for our clients.

Who This Is For

Including professionals, families, expats and borrowers navigating change across Australia.

Many of our clients are referred by accountants and other professional advisers.

How the Process Works

Meet Our Brokers

New enquiries should book a conversation. Phone numbers below are for existing clients or referred introductions only.

Phil Riches

CEO & Lead Mortgage Broker

Specialising in complex and self-employed lending.

Existing clients or referred introductions may call Phil directly on 0418 204 304.

Julianne Zammit

Senior Mortgage Broker

Known for precision with first home buyers and complex lending scenarios.

Existing clients or referred introductions may call Julianne directly on 0431 922 899.

Jason Wilkinson

Senior Mortgage Broker

Methodical, calm, and known for getting the details right.

Existing clients or referred introductions may call Jason directly on 0413 434 693.

Ian Hughes

Senior Mortgage Broker

Technical lending expert trusted by first-time buyers and professionals.

Existing clients or referred introductions may call Ian directly on 0403 522 961.

What Clients Say

Trusted by buyers, investors and self-employed borrowers.

Our clients are based across New South Wales, Queensland and beyond, with brokers who work remotely and in-market where required.

Ready to talk to a broker?

Get started online or book a call with one of our brokers — whichever suits you.

No obligation · No credit checks · Experienced brokers

Referred to us directly? You’re welcome to contact your broker on their direct number listed above.

Contact

Privacy Policy | Terms & Conditions | Dispute Resolution Policy

© 2025 Finance on the Coast, a division of Model Mortgages Pty Ltd | ACL No 387460 | ABN 82 108681063